Looking to know more about £29000 after tax in the UK? You’ve come to the right place! Understanding your take-home pay is vital for financial planning and making informed decisions. In this article, we’ll break down what £29000 after tax means in the UK and provide you with valuable insights into how it affects your overall income. Let’s dive right in and explore the nuances of £29000 after tax in the UK with clarity and simplicity.

Understanding £29000 After Tax UK

When it comes to understanding your income and how much you take home after taxes, it’s important to have a clear understanding of the figures. In the United Kingdom, £29,000 after tax can be a significant amount, but it’s essential to delve deeper into the details to fully comprehend its implications. This article will provide you with a comprehensive overview of £29,000 after tax in the UK, including how it is calculated, its purchasing power, and its impact on your personal finances.

How is £29000 After Tax Calculated?

Calculating your take-home pay after taxes can seem like a complex task. However, understanding how HM Revenue and Customs (HMRC) calculates taxes will help demystify the process. Here’s a breakdown of how your £29,000 annual income is calculated:

- Income Tax: In the UK, individuals are subject to a progressive tax system. This means that the more you earn, the higher the tax rate applied to your income. The income tax rates for the tax year 2021/2022 are as follows:

- Personal Allowance: Up to £12,570 (tax-free)

- Basic Rate: £12,571 to £50,270 (20% tax rate)

- Higher Rate: £50,271 to £150,000 (40% tax rate)

- Additional Rate: Over £150,000 (45% tax rate)

- National Insurance Contributions (NIC): NIC is another deduction to consider. Employees in the UK are required to pay Class 1 NIC contributions based on their earnings. For the tax year 2021/2022, the NIC rates are as follows:

- 12% on earnings between £9,568 and £50,270

- 2% on earnings above £50,270

Once your income tax and NIC contributions have been deducted, you will be left with your take-home pay, which in this case is £29,000. Understanding the breakdown of these deductions is crucial to gaining insights into your overall financial situation.

The Purchasing Power of £29000 After Tax in the UK

Now that we have a clearer picture of how £29,000 after tax is calculated, let’s explore its purchasing power in the UK. It’s important to note that the cost of living can vary depending on several factors, such as location and personal lifestyle choices. However, this section will provide you with a general understanding of how far your money can go:

1. Monthly Budget

When budgeting your monthly expenses, it’s essential to allocate your income effectively to cover both necessities and discretionary spending. Here’s a sample breakdown of how you might allocate your £29,000 after tax income:

- Housing and Utilities: £800

- Transportation: £300

- Groceries: £250

- Healthcare: £100

- Entertainment and Dining Out: £200

- Savings and Investments: £500

- Other Expenses: £500

Keep in mind that these figures are just examples and can vary based on individual circumstances. However, this budget breakdown provides a starting point for managing your monthly expenses and ensuring financial stability.

2. Housing Options

One of the most significant expenses for individuals or families is housing. The cost of rent or mortgage payments can make a substantial dent in your budget. Here’s what you can expect in terms of housing options with a £29,000 after-tax income:

- Renting: With a monthly budget of £800, you have the flexibility to consider various renting options. In some areas, this can allow you to rent a one-bedroom flat, while in others, you might have to consider a shared accommodation arrangement.

- Mortgage Payments: Depending on your financial situation and desired location, you may be able to afford mortgage payments for a property valued around £170,000 to £200,000. Keep in mind that this is a rough estimate, and seeking professional advice is highly recommended when considering homeownership.

3. Leisure and Entertainment

With a budget of £200 allocated to leisure and entertainment, you can enjoy a variety of activities throughout the month. This can include dining out occasionally, going to the movies, or participating in recreational hobbies. Remember to adjust your spending based on your personal preferences and priorities.

Impact of £29000 After Tax on Personal Finances

Understanding the impact of £29,000 after tax on your personal finances is crucial to achieving financial stability and planning for the future. Here are some key aspects to consider:

1. Saving and Investing

With a take-home pay of £29,000, it’s important to prioritize saving and investing. Building an emergency fund and planning for retirement are essential to ensure long-term financial security. Consider setting a percentage of your income aside for these purposes and explore suitable investment options that align with your risk tolerance and financial goals.

2. Debt Management

If you have existing debt, such as student loans or credit card balances, it’s important to manage it effectively. Allocate a portion of your income towards debt repayment to gradually reduce your outstanding balances. Prioritize high-interest debt first to minimize interest expenses over time.

3. Future Financial Goals

Everyone has unique financial goals, whether it’s buying a home, starting a family, or pursuing further education. With a £29,000 after-tax income, it’s important to set achievable goals and create a financial plan to work towards them. Consider consulting with a financial advisor to ensure your goals are realistic and aligned with your income.

In conclusion, gaining a thorough understanding of £29,000 after tax in the UK provides valuable insights into your financial situation. By comprehending the calculations behind your take-home pay, the purchasing power it holds, and the impact it has on your personal finances, you can make informed decisions for a brighter financial future.

£29,000 Salary After Tax Take Home Pay

Frequently Asked Questions

How much will I earn after tax with a salary of £29,000 in the UK?

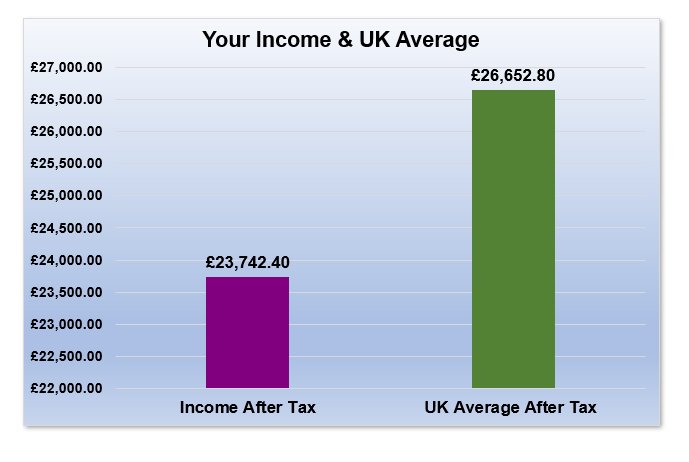

The amount you will earn after tax with a salary of £29,000 in the UK depends on various factors, including your tax code and any applicable deductions. However, as a general estimate, after tax, your take-home pay could be around £24,563 per year or approximately £2,047 per month.

What is the current income tax rate in the UK for someone earning £29,000?

For individuals earning £29,000 in the UK, the income tax rate as of 2021/2022 is 20%. This means that 20% of your earnings above the personal allowance threshold will be deducted as income tax.

Are there any other taxes or deductions I should consider apart from income tax?

Aside from income tax, there are a few other deductions you should consider, such as National Insurance contributions. The current National Insurance rates for someone earning £29,000 are 12% for earnings between £9,568 and £50,270, and 2% for earnings above £50,270. Additionally, other deductions like student loan repayments and pension contributions may also apply depending on your circumstances.

Will my salary of £29,000 place me in a specific tax bracket?

With a salary of £29,000, you will fall within the basic rate tax bracket in the UK. The basic rate tax bracket applies to individuals earning between £12,570 and £50,270 in the 2021/2022 tax year. This means that your income will be subject to a 20% income tax rate.

How can I calculate my take-home pay with a salary of £29,000 after tax?

To calculate your take-home pay with a salary of £29,000 after tax, you can subtract the income tax and National Insurance contributions from your gross salary. You may also need to consider other deductions such as pension contributions or student loan repayments. Alternatively, you can use online salary calculators or consult with a tax professional for a more accurate estimate.

Will my take-home pay of £29,000 after tax be the same each month?

Your take-home pay of £29,000 after tax may not be the same each month due to variations in deductions, such as National Insurance contributions or irregular payments like bonuses. It is advisable to review your payslips regularly and consult with your employer or a tax professional for a more accurate understanding of your monthly take-home pay.

Final Thoughts

In conclusion, earning £29000 after tax in the UK can provide a comfortable income for many individuals. It allows for financial stability and the ability to meet basic needs, as well as some room for discretionary spending. With careful budgeting and planning, this salary can also contribute towards savings and future goals. While it may not be considered a high-income level, £29000 after tax can still provide a satisfactory standard of living for individuals residing in the UK.